英語記事|Patrick Tsang’s Interview with i-CABLE “Money Facetime”

当記事は英語、中国語、広東語のみでの掲載です。中国語または広東語をお希望の場合は言語バーよりご変更ください。

Since the outbreak of Covid-19 and the US China trade war, both Hong Kong and mainland investors have faced many changes. We are very optimistic in several industries, including health tech, e-commerce, streaming media, and financial technology. IPOs in Hong Kong would increase as many overseas companies would return for the second listing. Hence, there will be more economic opportunities.

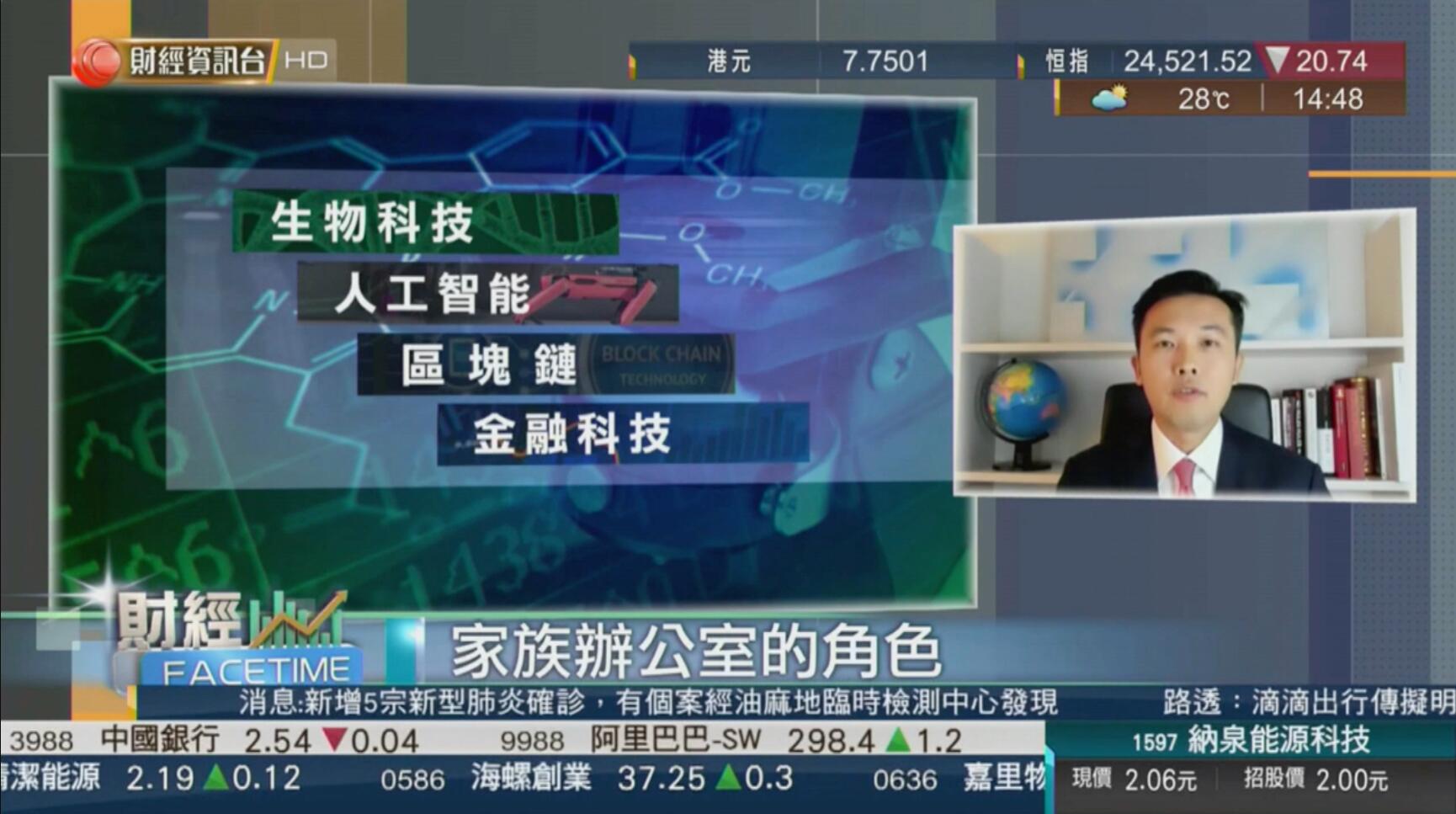

When evaluating investments, we look to invest in recession-proof businesses, for example, high-tech, AI, TMT, fintech, biotech, cleantech, environment, blockchain, etc. Our investment philosophy remains the same, to be opportunistic, and investing where there is positive influence and positive impact.

Despite Covid-19, our investment strategy remains unchanged. As JFK said, “crisis(危機)” in Chinese means danger(危) and opportunity(機). A successful example is fuboTV(NYSE: FUBO), one of our strategic investments, which had a successful IPO on the New York Stock Exchange recently. Our investment return for this investment was over 50 times in two years.

Tsangs Group is a China focused single family office combining the western management and eastern values. As one of the few family offices with a forward-thinking mindset, we can invest more in other industries besides real estate and contribute to society.

In Hong Kong, real estate usually plays a big part in the family offices. We are focusing more on technology investment to diversify and become a global leader and not just a follower.